Table of Contents

The Role of AI in Modern Financial Controlling

Unlike traditional controlling, artificial intelligence enhances financial analysis through advanced algorithms. This makes it significantly faster than conventional systems and enables much more accurate forecasts of incoming payments—both in terms of predicting cash flows based on historical transactions and anticipating potential payment delays through the detection of irregular payment behavior.

In general, AI helps simplify bookkeeping processes, leading to a more optimized and efficient accounting function overall. The new system can be seamlessly integrated into existing IT infrastructure. Implementing modern software ensures that your company is prepared for future challenges, as adopting such technologies is a response to evolving market demands and a strategic move to enhance competitiveness—an approach that few will be able to ignore in the near future.

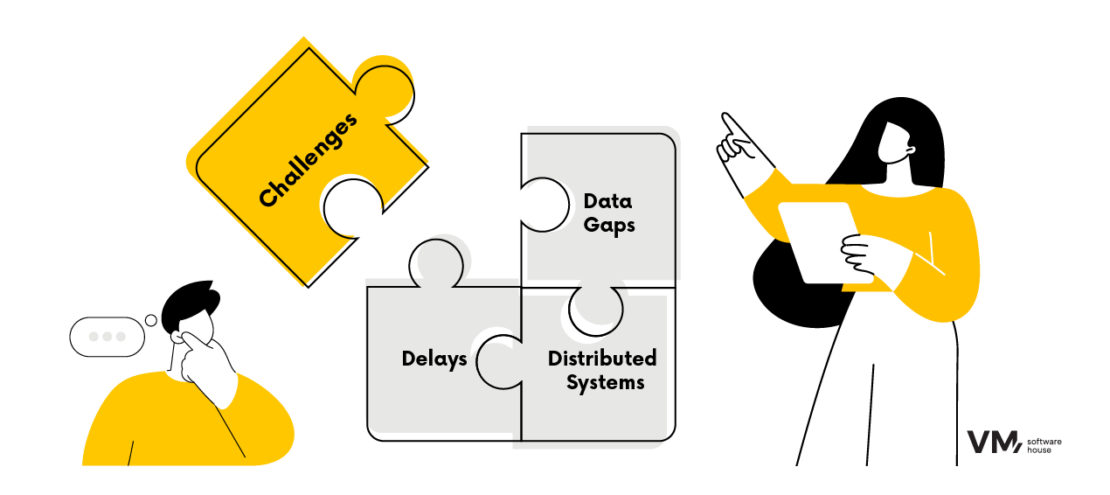

Forecasting Incoming Payments – What Challenges Do Finance Teams Face?

There are several factors that impact the accuracy of payment inflow forecasts:

- Data Gaps

Creating accurate forecasts becomes difficult when data sets are incomplete. - Customer Behavior

Changes in payment behavior are hard to predict and model reliably. - External Factors

Economic crises are difficult to foresee but can significantly affect payment patterns. - System Discrepancies

Using multiple financial systems can complicate data integration. - Delayed Data Updates

When information is updated with delays, forecasts rely on outdated data, making them less reliable. - Manual Processes

A lack of automation in certain areas can lead to data delays and limit the ability to perform real-time analysis.

These are just a few of the major challenges companies face when forecasting incoming payments.

How Artificial Intelligence Supports the Analysis of Customer Payment Behavior

One of the key advantages of AI-driven analysis is its ability to process all available data in real time. This allows artificial intelligence to classify customers by risk level with a level of precision that was previously unattainable—based on their payment history.

Despite the challenges of forecasting caused by the unpredictability of certain events, it is still possible to build a reliable early warning system that immediately detects and flags unusual payment behavior. These dynamic forecasts continuously adapt to changing data, and the inclusion of credit report information significantly increases the accuracy of the analysis. Customers with similar payment patterns are automatically grouped into segments by the system.

Long-term analysis also makes it possible to identify trends, such as seasonal fluctuations or industry-specific behaviors. With each step and every new forecast, the system learns through machine learning algorithms, making its automated action recommendations increasingly precise and insightful.

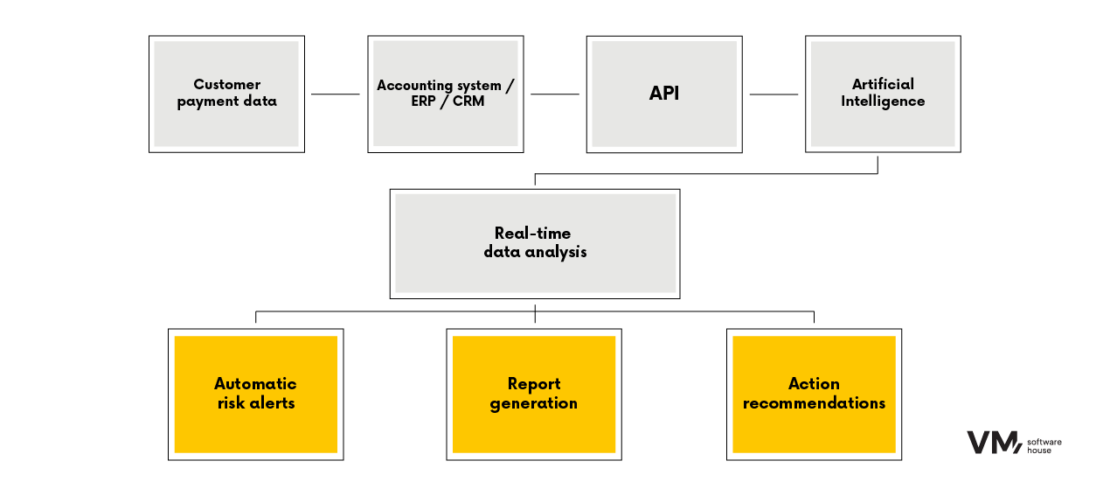

Integrating AI into Existing Financial Systems

The implementation of artificial intelligence in receivables management is carried out via API interfaces, which connect AI with your existing accounting software. Thanks to data automation, payment information is retrieved automatically and in real time.

AI integration for payment forecasting can be flexibly tailored to existing setups, as modern AI systems are highly compatible with widely used ERP and CRM platforms.

In addition to smart payment behavior analysis and automated risk assessment, integration also includes error detection in accounting records and automatic report generation. All processes comply with current data protection regulations and compliance standards.

Benefits of Using Artificial Intelligence in Financial Controlling

The most important advantages for the financial controlling department resulting from AI-driven improvements in receivables management include:

- Better liquidity planning

- Reduction in late or missed payments

- Greater forecasting reliability

- Reduced workload for staff

- Increased process transparency

- Risk minimization

- Lower operating costs

- Competitive advantage

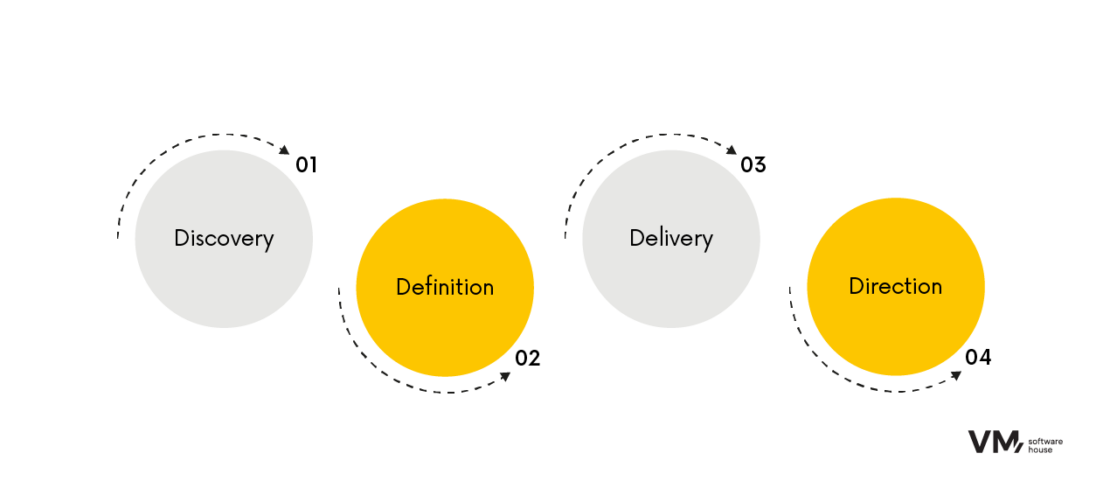

Stages of Implementing Artificial Intelligence in Controlling – Our Proven Operating Model

To effectively select the right tools for forecasting late payments using artificial intelligence, we begin with a detailed needs analysis. Based on this analysis, we design a custom AI model tailored to the structure and goals of your organization.

We follow a proven 4D model:

- Discovery

We start by analyzing your current processes and gaining a detailed understanding of how workflows are currently structured within your organization. - Definition

Together, we define the objectives and user requirements, determining the exact tasks the AI system should perform and how users will interact with it. - Delivery

These specifications are transformed into a functional prototype, which is then tested step by step. - Direction

As part of a continuous improvement process, the system is regularly optimized based on feedback, enabling ongoing development and adaptation to evolving needs.

Gain an Edge: What Artificial Intelligence Can Do for Your Company’s Finances

Implementing an AI-powered system brings significant benefits to financial analysis, risk assessment, liquidity planning, receivables management, and process automation.

Once implemented, the system continues to improve autonomously thanks to machine learning, which drives ongoing performance enhancements—especially in the area of liquidity forecasting. For that reason, it’s highly recommended to invest in AI-supported liquidity management as early as possible to stay ahead of the competition and mitigate financial risks.

Artificial Intelligence in Practice: Successful AI Implementations in Accounts Receivable Management

AI-powered systems have proven successful across various industries. Here are a few real-world examples:

- SAP (Walldorf) enabled improved liquidity planning.

- Collect.AI increased payment rates by an average of 30%.

- HighRadius helped reduce the receivables cycle time.

- Riverty enhanced the efficiency and accuracy of receivables management.

- Nexnet enables early risk detection and personalized communication in the dunning process through AI-based payment behavior analysis—resulting in higher collection success rates and stronger customer relationships.

What Does the Future of Financial Forecasting Look Like with Artificial Intelligence?

Although today’s AI systems are already highly efficient, the coming years are expected to bring another major leap in development. AI is becoming increasingly autonomous in its learning, and its field of application is expanding rapidly—particularly with the introduction of the so-called agent functionality, which will allow AI to independently carry out tasks in digital environments.

At the same time, the data foundations for insights will continue to grow, API compatibility will improve, and forecasts will be increasingly tailored to each company’s individual structure.

If you’d like to learn more about how our AI-based solutions can be implemented in your company, we’d be happy to schedule a personal consultation.