Artificial intelligence has reached a level of advancement that makes its use in professional financial environments—such as customer service chatbots—increasingly appealing. Key factors include clearly defined use cases, the ability to integrate with existing IT systems used by banks, and the advanced communication skills of modern banking chatbots. The combination of these elements makes this technology an innovative and forward-looking solution for the future.

Table of Contents

Product Name and Summary of Benefits

The financial chatbot is an intelligent assistant specifically designed for use in the banking sector, particularly to support customer advisory services. It can be seamlessly integrated with existing IT systems and is capable of conducting automated conversations with clients. It understands both spoken and written language, and provides responses in real time.

A banking chatbot is not only a valuable tool for customers—it can also be used by employees to retrieve data through natural language queries. The chatbot can analyze customer data, extract relevant information, perform automated tasks, and handle multiple requests simultaneously—quickly and reliably.

You decide which tasks the chatbot will handle and what data it will have access to. This results in a solution that is perfectly tailored to your company’s needs—meeting business requirements while ensuring full control over decision-making.

Benefits for Users

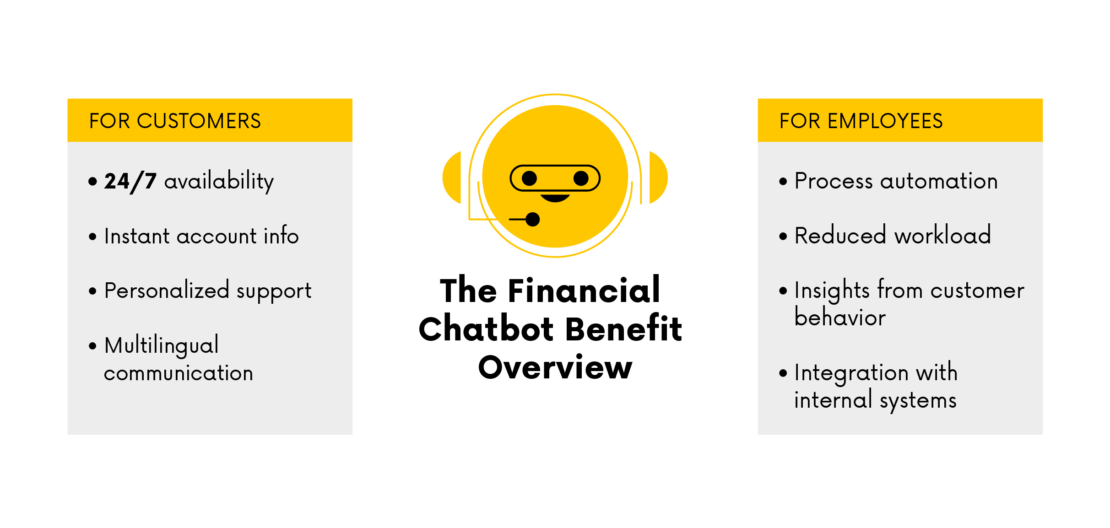

A chatbot in the banking sector is an assistant that isn’t limited by working hours—it’s available 24/7, including weekends and holidays. This means users no longer have to wait on hold or navigate phone queues—wait times are eliminated, and service becomes instant and convenient.

The chatbot is easy to use, with an intuitive interface, and can communicate with users in multiple languages. It has access to all relevant information, allowing customers to quickly retrieve details about their accounts without having to waste time navigating through complex menus. When needed, it can also send the appropriate documents.

It interacts with both customers and employees in a personalized manner—and works seamlessly on mobile devices as well. The chatbot understands the needs of its users, which translates into a higher level of customer satisfaction.

How We Do It – Our Methodology

At the core of our work lies the 4D model, which consists of four key phases:

- Discover

- Definition

- Delivery

- Direction

The 4D model is a structured process that covers all stages—from initial analysis to long-term project development. It begins with a feasibility study to assess whether and how the project can be technically implemented.

When designing a chatbot for the financial sector, we focus on intuitive use and high utility. The solution is developed step by step based on a transparent project plan, with full integration into the existing IT infrastructure. The chatbot also undergoes continuous improvement as part of an ongoing optimization process.

This open and flexible approach reflects our commitment to sustainable development—the chatbot is built for long-term use and can be easily adapted to meet future needs.

Sample Agenda

The approach to implementing automated customer service in banks largely depends on the specific circumstances of each case. The agenda below is therefore only an example and is always adapted and modified to meet your unique requirements and expectations.

- Kick-off and Goal Setting – What are the expectations and objectives of all project stakeholders?

- Analysis of Existing Processes – How are customer inquiries currently being handled?

- User Needs Identification – What do customers and employees expect from the solution?

- Technological Framework and Architecture – What technologies and structures are most appropriate?

- Assessment of Data Sources and Quality – What data is available and what is its quality?

- System Integration Planning – Which systems should the chatbot connect to?

- Prototyping and Testing – How does the first test version perform in an internal environment?

- Integration and Deployment – Launching the finalized chatbot in the production environment

- Training and Official Go-Live – Training employees and officially launching the chatbot

- Feedback Collection and Continuous Optimization – Gathering user feedback and refining the solution for future improvements

Your Benefits

The use of chatbots in the financial industry is undoubtedly a game-changing solution. Workflows become noticeably faster and more streamlined. In banking, chatbots relieve staff by handling a wide range of standard inquiries—repetitive tasks like address changes or account balance checks are fully automated. As a result, process efficiency improves, response times are reduced, and customer loyalty increases significantly.

An additional advantage is the valuable new data generated about customer behavior, which can be leveraged for marketing strategies or product development. Not only does the quality of this data improve, but its volume also grows—without the need for additional staffing costs.

A chatbot provides a real competitive edge and positively impacts your company’s financial performance from day one of implementation.

Next Steps – The 4D Model

Our 4D model is divided into four key phases:

- Discovery – defining the features and capabilities the chatbot should have

- Definition – setting goals and planning the necessary processes

- Delivery – developing, testing, and launching the chatbot

- Direction – continuously improving the bot after implementation

Throughout the project, all roles and communication methods are clearly defined. This structure allows for early identification of potential issues and enables quick implementation of preventive measures. In this context, it’s essential to realistically plan resources—budget, personnel, and timeline.

Each stage of the project is thoroughly documented to ensure full transparency throughout the entire process. This documentation is also crucial for ongoing system maintenance. Equally important is an iterative feedback system, with insights continuously fed into the solution’s ongoing development.

Introduction to Chatbots and Their Importance in the Financial Sector

Chatbots are an integral part of digital transformation and play a key role in the modernization of banks. AI-driven communication significantly enhances service efficiency and quality—not only by providing instant, 24/7 responses to customer inquiries but also by automating internal processes.

With chatbots, customers can independently and quickly perform their banking operations. For banks, this translates into reduced customer service costs, less pressure on call center staff, and a better response to the expectations of modern clients who demand digital services that are fast, simple, and available in real time.

Use Case Example: Customer Service Chatbot for a Bank

We’ve compiled a list of the most common examples of how this solution can be applied. This list can be expanded based on the individual needs and expectations of the institution.

- The chatbot can independently answer frequently asked questions (FAQs) without human assistance.

- Customers can check account information such as balances, transaction history, or spending limits.

- To help avoid missed payments, the bot can remind users about outstanding amounts or upcoming due dates.

- Clients can ask about specific transactions using natural language—for example, “What did I pay on May 12?”

- If necessary, the chatbot can redirect the customer to the appropriate department or specialist.

- The bot communicates in both spoken and written language.

- Customer inquiries are analyzed to help the bank better understand client needs and expectations.

- The chatbot can guide customers step-by-step through forms, such as loan applications, and assist with completing them.

- Customers can use the chatbot to schedule a callback with an advisor.

Features and Capabilities of a Financial Chatbot

Financial chatbots are built on advanced AI-powered language models that enable accurate recognition and interpretation of spoken language. The bot is integrated with the bank’s internal systems authorized for handling inquiries and can support both customers and employees through the available services.

Customer Acceptance and User Experience with Banking Chatbots

While studies show that most bank customers still prefer human interaction, that number is steadily declining. Research clearly indicates that this trend will continue—especially among younger generations, who are generally more open to new technologies and have a positive attitude toward interacting with banking chatbots. This shift is also driven by rapid improvements in chatbot language capabilities, which are becoming increasingly natural and easy to understand.

Client review

For one of the five largest banks in Europe, we developed software that enables early detection of customer churn risk. This allows the bank to take timely action to retain clients—an especially important benefit given the high cost of acquiring new customers.

Our solution is based on analyzing customer data for subtle indicators, such as a decrease in outgoing transfers or overall changes in usage behavior. Following the initial implementation, the account closure rate dropped by 6%, and the client expressed strong satisfaction with the results achieved.

Challenges and Limitations of Chatbots in Practice

Currently, chatbots face limitations when dealing with highly complex topics. Often, the issue lies not with the bots themselves, but with inaccurate or outdated data they rely on. Other challenges include lower acceptance among older customers, the lack of emotional intelligence, and concerns from some users regarding data privacy. However, these concerns are unfounded, as chatbots are subject to strict legal regulations that ensure high standards of security and privacy.

Data Protection and Security Aspects in Financial Sector Chatbot Applications

The chatbot fully complies with data protection regulations in force across the European Union, as outlined in the GDPR. All incoming and outgoing data is securely encrypted, and access to specific information is governed by a robust permission management system. Additionally, to ensure transparency and accountability, all user activities are logged and archived. The servers hosting the chatbot are also well protected and certified to meet stringent security standards.

Conclusions and Outlook: The Future of Chatbot Technology in the Financial Sector

The field of artificial intelligence is evolving rapidly, enabling chatbots to better understand individual user needs and tailor their responses accordingly. In the near future, chatbots will also be able to analyze images and documents, while customers will seamlessly switch between various communication channels—such as phone, app, or website—without losing context or information (so-called omnichannel interaction).

Additionally, chatbots will be capable of performing even more advanced analytics and generating more accurate predictions related to processes and user behavior. The quality of language interaction will continue to improve, and artificial intelligence will become a standard in banking—just as online banking is today.

Want to learn how AI can boost your company’s efficiency?

Get in touch with us—we’ll create a customized offer based on your organization’s specific needs.